Budget Timeline

The timeline at the top of this page outlines the key decision-making timeframes for the 2026 budget season. At each meeting, the relevant section of the budget will be approved in principle, meaning it is tentatively accepted, with the complete budget being formally adopted by City Council in late November.

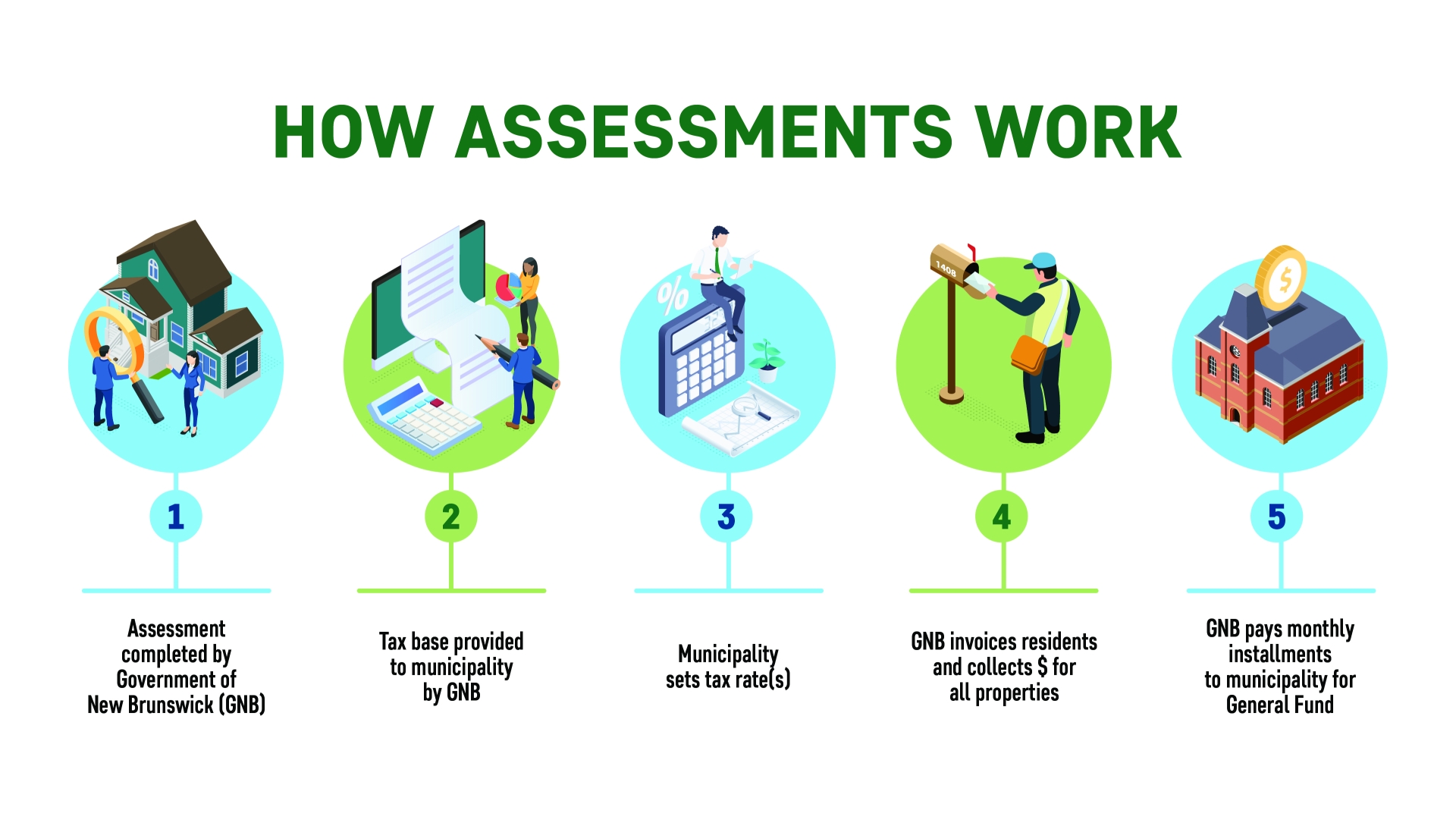

For 2026, the Government of New Brunswick introduced a one-year property assessment freeze for residential, non-residential, and industrial properties. This means the assessed value of your property will not change compared to last year.

This does not guarantee that your tax bill will not change. City Council will review the total tax base available, based on property assessments and budget pressures. They will then approve the tax rate per $100 of assessed value. Your tax bill is the assessed value of your property multiplied by the tax rate.

With the 2026 budget process, Fredericton is not just keeping up, we are planning ahead.